Back to Greenlands again, for the 7th time.

At first I thought it would serve as an "escape" for me, but once again I am proven wrong.

In the end, I reached the same conclusion as 10 years ago.

I really don't like this environment.

And I did the most WTF thing ever and probably pushing myself to the limits.

In an insomnia state, went to take a 2nd consecutive physical fitness test midway digging a grave.

And I still managed to pass! Even I am surprised.

Also, I reached the conclusion that my Insomnia is definitely not due to work, because it happens even when I'm in this place.

Saturday, November 24, 2018

Saturday, October 13, 2018

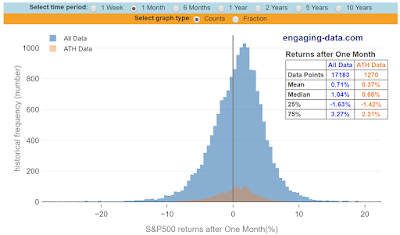

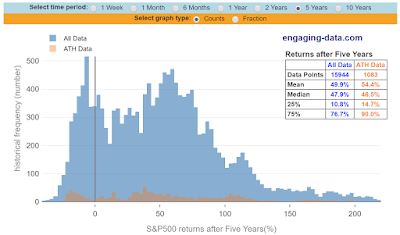

Why Long Term Investing Works - Explained By Visual

This could be one of the most insightful set of visuals.

If Millennials are planning for retirement 30-40 years from now, they should know the stock market has never cut a loss over any 20-year period from 1926–2015.

The odds of realizing a positive stock return are 100% over any 20-year period during that timeframe. Let me repeat. Stocks have never seen a loss over any 20-year time period from 1926-2015. Never. Not once.

But what about over shorter intervals, you ask? How about 10 years? A sobering 94% of the time there was a gain. 5 years? 86%.

What if you buy today and hope to sell it for a profit next week? Your chances are barely better than a coin flip.

Saturday, October 06, 2018

Letter To Shareholders (12) - Performance Review 2018Q3

Economy Commentary

Singapore market went through a mini rollercoaster ride in the past 3 months, going up to 3300 then down to 3100 and now back to 3200 again. Trade war seems to have no impact on the US markets as they kept breaking all time high.

From this quarter onwards, we will be discontinuing Quarterly Results Review - it seems to have became a "for the sake of writing" commentary providing only basic information without much substance. Instead, we shall integrate important portfolio developments in the Quarterly Performance Review.

Performance Review Highlights

Our portfolio was saved by the buyout offer of M1 shares (on the last day of Q3!), raising its value nearly 30% in a single day. Entire portfolio value skyrocketed $3700, which I believe is the largest ever single day increase.

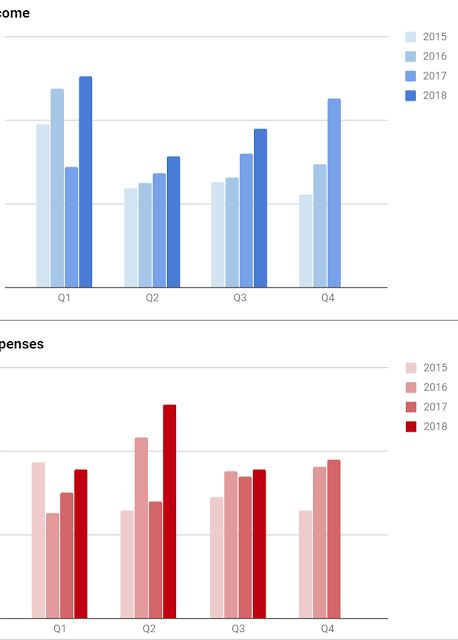

Operating Highlights - Income

Another all-time high quarter - Higher salary, higher passive income and even higher one-time income due to a recontract of mobile plan and selling iPhone for $560 profits. Unfortunately, the expiry of our old corporate plan also meant a much higher monthly recurring cost.

This was a big mistake on hindsight. I did not do enough research before re-contracting, and in the aftermath realized there were much cheaper SIM only plans with huge data, and cost only like $30 in the market. Instead, what I got was a $60 plan with upfront $560 "profits" to spread out the cost.

All in all, it wasn't worth it. I was tricked into believing:

1. My corporate plan discount was higher than what was advertised (turned out the promotion expired like 3 days before I recontract) I did not re-confirmed the discount rate again when I signed.

2. False advertising by a very enthusiastic Citibank Credit Card salesguy, mislead me into believing the benefits are good when there are many terms and clauses making it difficult to hit the advertised rebate rate (common trick by many banks. Haiz. I should have been more aware.)

This mistake is probably going to cost me hundred dollars or so, and lesser data/month for the next 2 years. I really learnt my lesson from this. Always double check!

Operating Highlights - Expenses

Recurring expenses/one-time expenses were both in-line with the past 3 years, with the traditional August angbao for Mum.

Acquisitions & Developments

We brought Kimly early this quarter based on the same proposition:

Kimly - Defensive consumer staple with strong cash flow, high cash balance and organic growth prospects. This is more of a capital-gain and opportune play.

We sold Capitamall Trust to earn some "coffee money". Hopefully we will get a chance to buy it back soon (afternote: we did), as Funan should provide some catalyst for the longer term. We are not so sure about the Westgate acquistion.

Operating Updates

Finally decided to do a little streamlining by closing our OCBC360 account. The $3000 could be better off earning $5/mth in DBS Multiplier compared to $0.70 per month in OCBC360.

We delayed so long mainly due to GIRO and other stock crediting arrangements, but now I realize it's not that difficult to switch. Everything can be done online and essentially a new submission will overwrite the previous. This will also reduce the hassle of transferring small amounts here and there just to pay different bills every month.

With that, we officialy say goodbye to OCBC360 which has accompanied us for more than 5 yrs.

Outlook

My working capital remains lean, with about 3 bullets (1.5 bullet from the recent sale of CMT) to play around with. We intend to selectively "trade" using what we have right now while waiting for the big refill in December to come in. The future of Kimly will make or break our portfolio this year.

2018 is shaping up to be another milestone year as we break major goals: "25 years expense" holy grail, 5 digits passive income and more. Looking forward to the annual report!

Some stocks on our watchlist include:

STI ES3 (3.2), ST Engineering (3.2), Capitaland (2.8), Sembcorp Ind (2.5 or 75% of book value), Mapletree Commercial Trust (1.55), Singtel (3), Raffles Medical Group (0.9), Far East HTrust (0.6 or 6.5% yield), Frasers Property (Below 1.6, NAV at 2.45, 8.6c dividend over 5% yield)

Singapore market went through a mini rollercoaster ride in the past 3 months, going up to 3300 then down to 3100 and now back to 3200 again. Trade war seems to have no impact on the US markets as they kept breaking all time high.

From this quarter onwards, we will be discontinuing Quarterly Results Review - it seems to have became a "for the sake of writing" commentary providing only basic information without much substance. Instead, we shall integrate important portfolio developments in the Quarterly Performance Review.

Performance Review Highlights

Our portfolio was saved by the buyout offer of M1 shares (on the last day of Q3!), raising its value nearly 30% in a single day. Entire portfolio value skyrocketed $3700, which I believe is the largest ever single day increase.

We are down 4% year to date compare to 1% down of the STI, mostly dragged down by Kimly. Excluding this stock, we would be nearly even. Would our growth assessment of this coffee shop business come true? Or will this huge position left a huge scar in our portfolio? Only time will tell and 2019 should be a game changing year.

We gave out $2600 worth of dividends (thanks to a massive distribution from Singtel) which is once again our best Q3 yet. This will be a record-breaking year of dividends!

Another all-time high quarter - Higher salary, higher passive income and even higher one-time income due to a recontract of mobile plan and selling iPhone for $560 profits. Unfortunately, the expiry of our old corporate plan also meant a much higher monthly recurring cost.

This was a big mistake on hindsight. I did not do enough research before re-contracting, and in the aftermath realized there were much cheaper SIM only plans with huge data, and cost only like $30 in the market. Instead, what I got was a $60 plan with upfront $560 "profits" to spread out the cost.

All in all, it wasn't worth it. I was tricked into believing:

1. My corporate plan discount was higher than what was advertised (turned out the promotion expired like 3 days before I recontract) I did not re-confirmed the discount rate again when I signed.

2. False advertising by a very enthusiastic Citibank Credit Card salesguy, mislead me into believing the benefits are good when there are many terms and clauses making it difficult to hit the advertised rebate rate (common trick by many banks. Haiz. I should have been more aware.)

This mistake is probably going to cost me hundred dollars or so, and lesser data/month for the next 2 years. I really learnt my lesson from this. Always double check!

Operating Highlights - Expenses

Recurring expenses/one-time expenses were both in-line with the past 3 years, with the traditional August angbao for Mum.

Acquisitions & Developments

We brought Kimly early this quarter based on the same proposition:

Kimly - Defensive consumer staple with strong cash flow, high cash balance and organic growth prospects. This is more of a capital-gain and opportune play.

Operating Updates

Finally decided to do a little streamlining by closing our OCBC360 account. The $3000 could be better off earning $5/mth in DBS Multiplier compared to $0.70 per month in OCBC360.

We delayed so long mainly due to GIRO and other stock crediting arrangements, but now I realize it's not that difficult to switch. Everything can be done online and essentially a new submission will overwrite the previous. This will also reduce the hassle of transferring small amounts here and there just to pay different bills every month.

With that, we officialy say goodbye to OCBC360 which has accompanied us for more than 5 yrs.

Outlook

2018 is shaping up to be another milestone year as we break major goals: "25 years expense" holy grail, 5 digits passive income and more. Looking forward to the annual report!

Some stocks on our watchlist include:

STI ES3 (3.2), ST Engineering (3.2), Capitaland (2.8), Sembcorp Ind (2.5 or 75% of book value), Mapletree Commercial Trust (1.55), Singtel (3), Raffles Medical Group (0.9), Far East HTrust (0.6 or 6.5% yield), Frasers Property (Below 1.6, NAV at 2.45, 8.6c dividend over 5% yield)

What Everybody Is Getting Wrong About FIRE

Another classic MMM article that will go down in history.

Strong valid points and rebuttal against all the FIRE-nayers, either because they are ignorant/misunderstood about what FIRE truly stands for, or they have a psychological problem of financial fear.

No matter how you look at it, FIRE can only be a good thing.

FIRE is not about early retirement.

FIRE is about giving you the freedom to be the happiest person you can possibly be.

When I see celebrities with 20M networth criticizing FIRE, they will probably say the same thing when they reach 200M networth.

How much is enough? Until the day you die?

Once again, nay-sayers are entertainment at best.

MMM is the real deal.

Strong valid points and rebuttal against all the FIRE-nayers, either because they are ignorant/misunderstood about what FIRE truly stands for, or they have a psychological problem of financial fear.

No matter how you look at it, FIRE can only be a good thing.

FIRE is not about early retirement.

FIRE is about giving you the freedom to be the happiest person you can possibly be.

When I see celebrities with 20M networth criticizing FIRE, they will probably say the same thing when they reach 200M networth.

How much is enough? Until the day you die?

Once again, nay-sayers are entertainment at best.

MMM is the real deal.

Wednesday, July 11, 2018

Letter To Shareholders (11) - Performance Review 2018Q2

Economy Commentary

Market slip further into correction terriority - falling from its peak of 3600+ points in mid May to its current 3200+ points, mostly on fear of trade war between China and America. Yes, we are on the brink of war. Year to date, STI is down about 2%.

Locally, we can see a how a seemingly defensive and government link business - Hyflux, can be brought down by immense debts and losses.

Performance Review Highlights

Our portfolio suffered an almost $10K decline in 1 single quarter, despite a much less severe correction compared to 2015. It proves how much our portfolio have grown - 3 times bigger than 3 years ago. After meeting our warchest goal in 2017, we have been dedicating all future incomes to investments.

YTD, we underperformed the STI (chunking up 8% losses), mostly due to the continued decline in Telco industry (our biggest holding) and to a lesser extend, REITs and Property. Thanks to the dividends collected over the years, we are still in the green.

We took up 3 big positions this quarter - Netlink Trust, Kimly and adding further into Singtel. We paid out $1500 in dividends in Q2, the highest Q2 payout since inception. At this rate, we should have no issue hitting 5 digits passive income for the year.

Operating Highlights - Income

Q2 income is at all time high, mostly from higher salary (increment and benefits) and passive income. Compare to 2015, our salary have increased almost 30% and our passive income have grown almost 75%!

Operating Highlights - Expenses

Expenses were horrendously high due to much higher than expected costs during the April vacation, costing nearly $3000 alone in total. It really went beyond my budget.

For recurring expenses, aside from some personal products and a pair of new office shoes (old one was 3 years old and think starting to grow mould), everything else were quite minimal (in line with other years)

Singtel - We did not expect the support at $3.3 to give way, but it did. We accumulate yet again at 5.6% commited yield. We first brought into this company at 4.5% yield, so there is no reason why we would not at this price.

Outlook

With the recent acquisitions, we have almost depleted all our working capital. Barring a greater market correction (STI to 3000points), we likely would not dip into our warchest. Our plan is to invest as we re-accumulate our working capital through monthly cash inflow. Instead of buying new stuff, we will actively look for opportunities to do some capital recycling in the next quarter.

Some stocks on our watchlist include:

STI ES3 (3.2), ST Engineering (3.2), Capitaland (2.8), Sembcorp Ind (2.5 or 75% of book value), Mapletree Commercial Trust (1.55), Singtel (3), Raffles Medical Group (0.9), Ascendas H-Reit (0.75), EC World Reit (0.68).

Market slip further into correction terriority - falling from its peak of 3600+ points in mid May to its current 3200+ points, mostly on fear of trade war between China and America. Yes, we are on the brink of war. Year to date, STI is down about 2%.

Locally, we can see a how a seemingly defensive and government link business - Hyflux, can be brought down by immense debts and losses.

Performance Review Highlights

Our portfolio suffered an almost $10K decline in 1 single quarter, despite a much less severe correction compared to 2015. It proves how much our portfolio have grown - 3 times bigger than 3 years ago. After meeting our warchest goal in 2017, we have been dedicating all future incomes to investments.

YTD, we underperformed the STI (chunking up 8% losses), mostly due to the continued decline in Telco industry (our biggest holding) and to a lesser extend, REITs and Property. Thanks to the dividends collected over the years, we are still in the green.

We took up 3 big positions this quarter - Netlink Trust, Kimly and adding further into Singtel. We paid out $1500 in dividends in Q2, the highest Q2 payout since inception. At this rate, we should have no issue hitting 5 digits passive income for the year.

Q2 income is at all time high, mostly from higher salary (increment and benefits) and passive income. Compare to 2015, our salary have increased almost 30% and our passive income have grown almost 75%!

Operating Highlights - Expenses

Expenses were horrendously high due to much higher than expected costs during the April vacation, costing nearly $3000 alone in total. It really went beyond my budget.

For recurring expenses, aside from some personal products and a pair of new office shoes (old one was 3 years old and think starting to grow mould), everything else were quite minimal (in line with other years)

Acquisitions

3 big positions taken up this term:

Netlink NBN Trust - This will further beef up our dividend portfolio as we believe this defensive monopoly that will form the backbone of Smart Nation in the next 20 years. We expect earnings and dpu to be minimally around 4.5c (5.5% yield), and in optimal case up to 6% yield on cost. Unless the price drops drastically (which is highly unlikely), we will freeze it for pure income.

Kimly - Defensive consumer staple with strong cash flow and organic growth prospects. This is more of a capital-gain and opportune play.

Netlink NBN Trust - This will further beef up our dividend portfolio as we believe this defensive monopoly that will form the backbone of Smart Nation in the next 20 years. We expect earnings and dpu to be minimally around 4.5c (5.5% yield), and in optimal case up to 6% yield on cost. Unless the price drops drastically (which is highly unlikely), we will freeze it for pure income.

Kimly - Defensive consumer staple with strong cash flow and organic growth prospects. This is more of a capital-gain and opportune play.

Outlook

Some stocks on our watchlist include:

STI ES3 (3.2), ST Engineering (3.2), Capitaland (2.8), Sembcorp Ind (2.5 or 75% of book value), Mapletree Commercial Trust (1.55), Singtel (3), Raffles Medical Group (0.9), Ascendas H-Reit (0.75), EC World Reit (0.68).

Sunday, June 03, 2018

5th Mayday Concert - Life Unlimited

This concert is dedicated to my 1 day dream. The happiest and most heart-breaking 1 day of my life - the dream of a fairytale love story (Private Post).

----

First party at the Sports Hub!

The good:

- A "fuller" song list compare to the previous concert, and also inclusion of new songs (终于结束的起点).

- Sound system is fine unlike previous bad reviews.

- "这一生只愿只要平凡快乐,谁说这样不伟大呢" 😭

- Surprise 大咖 guest uncle?! (Based on past exp, I have already resigned to having 路人 tier as their guests)

- 志明与春娇,30 seconds of 心中无别人.

- Got to experience 2 standard endings in one event. (憨人 and 倔强 - Usually only 1 of them happens)

The "too bad":

- Notable missing classics: 温柔, 终结孤单, 孙悟空

- Missing personal favourites: 步步, 星空, 仓颉, 勇敢, 如烟

- Big guest only sing 1 song and it's not even his most well known one? And leave stage when the song not even ended. -.-

- Ended earlier than usual.

The bad:

- We really sucks at calling for encore =.=

- Why is everyone around me so 冷静 😣

- And is it just me who prefer the indoor stadium more?

Conclusion:

- Buying cheap seats really sucks. Hard to get high when the people around you are all so "gloomy".

- Based on past experience, standing in the pit kinda sucks for me too (too short, end up see screen).

- So far, my most enjoyable has been to sit at CAT2. Gonna keep this in mind for future concerts.

----

Song list: Looking back at the 2016 post, I realized they actually sang much lesser songs.

1. 派對動物

2. 傷心的人別聽慢歌

3. OAOA

4. 入陣曲

5. 超人

Short film

6. 你不是真正的快樂

Talking

7. 戀愛ing

Talking

8. 笑忘歌

Talking

9. 乾杯

10. 兄弟

11. 人生有限公司

Short film

12. 成名在望

13. 我心中尚未崩壞的地方

14. 知足

15. 少年他的奇幻漂流

16. 頑固

Short film

17. I will carry you

18. 離開地球表面

19. 凡人歌 (special guest 李宗盛)

20. 山丘(李宗盛)

21. 任意門

22. 人生海海

Encore I

23. 終於結束的起點

24. 我不願讓你一個人

25. 轉眼

Encore II

26. 志明與春嬌

27. 突然好想你

28. 憨人

29. 心中無別人

Encore III

30. 倔強

----

First party at the Sports Hub!

The good:

- A "fuller" song list compare to the previous concert, and also inclusion of new songs (终于结束的起点).

- Sound system is fine unlike previous bad reviews.

- "这一生只愿只要平凡快乐,谁说这样不伟大呢" 😭

- Surprise 大咖 guest uncle?! (Based on past exp, I have already resigned to having 路人 tier as their guests)

- 志明与春娇,30 seconds of 心中无别人.

- Got to experience 2 standard endings in one event. (憨人 and 倔强 - Usually only 1 of them happens)

The "too bad":

- Notable missing classics: 温柔, 终结孤单, 孙悟空

- Missing personal favourites: 步步, 星空, 仓颉, 勇敢, 如烟

- Big guest only sing 1 song and it's not even his most well known one? And leave stage when the song not even ended. -.-

- Ended earlier than usual.

The bad:

- We really sucks at calling for encore =.=

- Why is everyone around me so 冷静 😣

- And is it just me who prefer the indoor stadium more?

Conclusion:

- Buying cheap seats really sucks. Hard to get high when the people around you are all so "gloomy".

- Based on past experience, standing in the pit kinda sucks for me too (too short, end up see screen).

- So far, my most enjoyable has been to sit at CAT2. Gonna keep this in mind for future concerts.

----

Song list: Looking back at the 2016 post, I realized they actually sang much lesser songs.

1. 派對動物

2. 傷心的人別聽慢歌

3. OAOA

4. 入陣曲

5. 超人

Short film

6. 你不是真正的快樂

Talking

7. 戀愛ing

Talking

8. 笑忘歌

Talking

9. 乾杯

10. 兄弟

11. 人生有限公司

Short film

12. 成名在望

13. 我心中尚未崩壞的地方

14. 知足

15. 少年他的奇幻漂流

16. 頑固

Short film

17. I will carry you

18. 離開地球表面

19. 凡人歌 (special guest 李宗盛)

20. 山丘(李宗盛)

21. 任意門

22. 人生海海

Encore I

23. 終於結束的起點

24. 我不願讓你一個人

25. 轉眼

Encore II

26. 志明與春嬌

27. 突然好想你

28. 憨人

29. 心中無別人

Encore III

30. 倔強

Friday, June 01, 2018

Quarterly Results Review - 2018Q1

M1

The results were just as I expected as mobile service revenue and profit increased slightly for the first time in a long time, signialling that earnings indeed bottomed in the last quarter. Of course, this is until TPG enters the battlefield.

At worst I forsee another 5-10% drop in earnings. EPS is 14.c in Y2017 - Assuming the worst case drop and EPS of 12.8c, an 80% payout ratio is 10.3c DPU which at $1.74 still gives a 5.9% yield. Assuming a steady DPU of 11c, we are hoping it would yield 6.3%. They have lot of initiatives such as waste management, SG bikes, corporate segment growth which we hope would eventually replace the declining mobile revenue. A secondary factor is confidence boost by several like-minded investors.'

As before, they are branching into other areas like malware detection solutions, nationwide IOT, smart sensors, "intelligent" waste management system, cloud offering of digital startups. Whether they will take off remains to be seen.

For now, my preference would be to take a small "swing" position to slowly recoup the losses, targetting to sell a portion above $1.9 (less than 6% yield) and buy should it come down to a reasonable price.

CapitaCommercial Trust

Headline figure was quite misleading as DPU drop 10+% due to the enlarged units base. Otherwise, DPU would have increased 7.6%.

Good results (DPU up 8.66%, 6% higher) but the stock price have shot through the sky. I really should have grit my teeth and sell when it was at more than $2. It is really unstainable considering the yield at that price is below 5%.

I believe it would be more fairly valued at $1.65 for a 5.5% yield, or at best $1.8 for 5% yield. The market are pricing in lot of growth from their AEI and Asia Square acquisition.

CapitaMall Trust

Slight increase in DPU to 2.78c for 1Q, and seems to be on track on meeting the 11c target. Yield remains at 5.4% yield at ~$2.0x.

Announced divestment of Sembawang Shopping Centre which consist of only ~1% of CMT asset, but the surprise was selling it for ~$248m when the independent valuation is only half of that. Forumers who attended AGM mentioned CMT are conservative on their valuation, which seems to be good news if this sale hold any truth.

Starhill Global Trust

Starhill results slightly worse than I expected with DPU dropping by 7.6% (thought max would drop by 5%). Not sure how big a role the renovations played but a 7+% shopper traffic drop at Wisma seems bad. Hopefully DPU will stabalize in 2H with AEI completion in Australia.

Frasers Centrepoint Trust

In summary a good set of results led by Northpoint City.

DPU of 3.10 cents, up 2.0% year-on-year (2Q17 DPU: 3.04 cents)

Gross Revenue of $48.6 million, up 6.3% year-on-year

Net Property Income of $34.8 million, up 6.9% year-on-year

NAV per Unit of $2.03 as at 31 March 2018 (31 Dec 2017: $2.02)

Gearing level at 29.2% as at 31 March 2018 (31 Dec 2017: 29.4%)

Frasers Property

Results swell this quarter to make up for the huge hit last quarter. Recurring income maintained at around 70%.

Frasers Centrepoint Limited renamed. Its share price has been on a downtrend since hitting $2.25.

Current NAV fell 4c to $2.42, and I expect dividends to be maintained at 8.6c a year (roughly 60% oapyout ratio). I am really treating this as an ETF and not reading much into the details. might add on more should it come to $1.7 (30% discount to NAV, 5% yield).

Far East Hospitality Trust

Finally we see glimpse of recovery after many consecutive quarters of DPU fall - it rises 1% to 0.94c.

With contribution from Oasis Hotel Downtown (acquired on 2nd April) and recovery in the industry, better times and DPU should be ahead. Slight drag from Service Residences.

At 67c, this is one of the REIT which haven't run up significantly in price. I might consider adding if there are no better deals and it drops a bit more (to say around 63c).

Expect total DPU of 4c, which gives a yield of around 6%.

Sembcorp Industries

Almost all analysts are predicting $3.5 to as high as $4.4 target prices, but I still see no major turning point in the results. Yield at current price is a pathetic 2% and I am really reluctant to average down on this (I can get better yield from my banks).

Good points? The IPO in India is the major catalyst, and it is trading at relatively big discount to NAV of $3.6. If it falls to $2.70 I might do an average down.

Netlink Trust

Higher than IPO forcasted DPU of 3.24c declared. At $0.81, forecasted yield is around 5.7%

I have built a substantial position in this, and this will form a decent pillar in my dividend income.

Link to DBS Report

Singtel

Management finally committed to a dividend guidance of 17.5c, although I have never doubted Singtel ability to maintain it. This is definitely meant to assure investors in face of earning pressure (profits -18% in Q4). Payout ratio is at the highest at 81%.

At $3.40, Singtel currently trades at 10x EV/EBITDA (minus -2SD from historical mean), below its five year historical mean of 12x. It is also supported by a attractive yield of 5.1%. P/E is close to 10!

I would definitely add on more if I weren't already so heavily vested in it. I think I will fire one more bullet should it falls to $3.3, and reserve 1 final bullet for $3.

Accordia Golf Trust

Yield has gone down to 6% from the 7.5% I estimated when I first invested in this counter (roughly same price). Full year DPU is now just 3.85c, down from 6.04c last year. NAV stands at 90c.

It was hurt really badly by membership deposit in 1H and I doubt it will ever go back up to 78 high again. Utilization rates also plummet in Jan to Mar.

Management continue to iterate Japan's economy recovery, hopefully it prorpogates down to this counter. I will seriously consider selling it if the price rebounds or fundamentals continue to weaken (it has weaken for 3 quarters).

Watchlist / Potential

M1 - Will sell this at $1.8+ to reduce exposure to Telco sector.

Singtel - Extremely attractive at committed 5.2% yield. Below $3.3.

Raffles Medical Group - Closer to $1. High P/E but long term growth story. China is make or break.

Comfort Delgro - $1.9 and below would be extremely tempting but boat is gone.

SGX - Closer to $7. India exchange saga impact unknown.

ThaiBev - A lot hinges on their Vision 2020. Debt is crazy after the acquisition spree. Results were bad as expected consumer recovery did not happen. Currently at 17.5 P/E, -1sd below 5 year average. 70c maybe?

Mapletree Comm Trust - Closer to $1.5, camping at 6% yield. NAV is $1.37.

ST Engineering - Would likely bite at 5% yield (closer to $3)

[Obsolete]

Capitaland - Look closer to $3.3 or below.

Mapletree Greater China Trust - $1.1 or when it retract to more than 7% yield.

Mapletree Logistic Trust - Despite >10% retracement still pretty expensive. If it comes closer to book value, say $1.1.

The results were just as I expected as mobile service revenue and profit increased slightly for the first time in a long time, signialling that earnings indeed bottomed in the last quarter. Of course, this is until TPG enters the battlefield.

At worst I forsee another 5-10% drop in earnings. EPS is 14.c in Y2017 - Assuming the worst case drop and EPS of 12.8c, an 80% payout ratio is 10.3c DPU which at $1.74 still gives a 5.9% yield. Assuming a steady DPU of 11c, we are hoping it would yield 6.3%. They have lot of initiatives such as waste management, SG bikes, corporate segment growth which we hope would eventually replace the declining mobile revenue. A secondary factor is confidence boost by several like-minded investors.'

As before, they are branching into other areas like malware detection solutions, nationwide IOT, smart sensors, "intelligent" waste management system, cloud offering of digital startups. Whether they will take off remains to be seen.

For now, my preference would be to take a small "swing" position to slowly recoup the losses, targetting to sell a portion above $1.9 (less than 6% yield) and buy should it come down to a reasonable price.

CapitaCommercial Trust

Headline figure was quite misleading as DPU drop 10+% due to the enlarged units base. Otherwise, DPU would have increased 7.6%.

Good results (DPU up 8.66%, 6% higher) but the stock price have shot through the sky. I really should have grit my teeth and sell when it was at more than $2. It is really unstainable considering the yield at that price is below 5%.

I believe it would be more fairly valued at $1.65 for a 5.5% yield, or at best $1.8 for 5% yield. The market are pricing in lot of growth from their AEI and Asia Square acquisition.

CapitaMall Trust

Slight increase in DPU to 2.78c for 1Q, and seems to be on track on meeting the 11c target. Yield remains at 5.4% yield at ~$2.0x.

Announced divestment of Sembawang Shopping Centre which consist of only ~1% of CMT asset, but the surprise was selling it for ~$248m when the independent valuation is only half of that. Forumers who attended AGM mentioned CMT are conservative on their valuation, which seems to be good news if this sale hold any truth.

Starhill Global Trust

Starhill results slightly worse than I expected with DPU dropping by 7.6% (thought max would drop by 5%). Not sure how big a role the renovations played but a 7+% shopper traffic drop at Wisma seems bad. Hopefully DPU will stabalize in 2H with AEI completion in Australia.

Frasers Centrepoint Trust

In summary a good set of results led by Northpoint City.

DPU of 3.10 cents, up 2.0% year-on-year (2Q17 DPU: 3.04 cents)

Gross Revenue of $48.6 million, up 6.3% year-on-year

Net Property Income of $34.8 million, up 6.9% year-on-year

NAV per Unit of $2.03 as at 31 March 2018 (31 Dec 2017: $2.02)

Gearing level at 29.2% as at 31 March 2018 (31 Dec 2017: 29.4%)

Results swell this quarter to make up for the huge hit last quarter. Recurring income maintained at around 70%.

Frasers Centrepoint Limited renamed. Its share price has been on a downtrend since hitting $2.25.

Current NAV fell 4c to $2.42, and I expect dividends to be maintained at 8.6c a year (roughly 60% oapyout ratio). I am really treating this as an ETF and not reading much into the details. might add on more should it come to $1.7 (30% discount to NAV, 5% yield).

Far East Hospitality Trust

Finally we see glimpse of recovery after many consecutive quarters of DPU fall - it rises 1% to 0.94c.

With contribution from Oasis Hotel Downtown (acquired on 2nd April) and recovery in the industry, better times and DPU should be ahead. Slight drag from Service Residences.

At 67c, this is one of the REIT which haven't run up significantly in price. I might consider adding if there are no better deals and it drops a bit more (to say around 63c).

Expect total DPU of 4c, which gives a yield of around 6%.

Sembcorp Industries

Almost all analysts are predicting $3.5 to as high as $4.4 target prices, but I still see no major turning point in the results. Yield at current price is a pathetic 2% and I am really reluctant to average down on this (I can get better yield from my banks).

Good points? The IPO in India is the major catalyst, and it is trading at relatively big discount to NAV of $3.6. If it falls to $2.70 I might do an average down.

Netlink Trust

Higher than IPO forcasted DPU of 3.24c declared. At $0.81, forecasted yield is around 5.7%

I have built a substantial position in this, and this will form a decent pillar in my dividend income.

Link to DBS Report

Management finally committed to a dividend guidance of 17.5c, although I have never doubted Singtel ability to maintain it. This is definitely meant to assure investors in face of earning pressure (profits -18% in Q4). Payout ratio is at the highest at 81%.

At $3.40, Singtel currently trades at 10x EV/EBITDA (minus -2SD from historical mean), below its five year historical mean of 12x. It is also supported by a attractive yield of 5.1%. P/E is close to 10!

I would definitely add on more if I weren't already so heavily vested in it. I think I will fire one more bullet should it falls to $3.3, and reserve 1 final bullet for $3.

Accordia Golf Trust

Yield has gone down to 6% from the 7.5% I estimated when I first invested in this counter (roughly same price). Full year DPU is now just 3.85c, down from 6.04c last year. NAV stands at 90c.

It was hurt really badly by membership deposit in 1H and I doubt it will ever go back up to 78 high again. Utilization rates also plummet in Jan to Mar.

Management continue to iterate Japan's economy recovery, hopefully it prorpogates down to this counter. I will seriously consider selling it if the price rebounds or fundamentals continue to weaken (it has weaken for 3 quarters).

Watchlist / Potential

M1 - Will sell this at $1.8+ to reduce exposure to Telco sector.

Singtel - Extremely attractive at committed 5.2% yield. Below $3.3.

Raffles Medical Group - Closer to $1. High P/E but long term growth story. China is make or break.

Comfort Delgro - $1.9 and below would be extremely tempting but boat is gone.

SGX - Closer to $7. India exchange saga impact unknown.

ThaiBev - A lot hinges on their Vision 2020. Debt is crazy after the acquisition spree. Results were bad as expected consumer recovery did not happen. Currently at 17.5 P/E, -1sd below 5 year average. 70c maybe?

Mapletree Comm Trust - Closer to $1.5, camping at 6% yield. NAV is $1.37.

ST Engineering - Would likely bite at 5% yield (closer to $3)

[Obsolete]

Capitaland - Look closer to $3.3 or below.

Mapletree Greater China Trust - $1.1 or when it retract to more than 7% yield.

Mapletree Logistic Trust - Despite >10% retracement still pretty expensive. If it comes closer to book value, say $1.1.

Monday, May 28, 2018

China Primary School Kid Knows FIRE

When a kid knows more about FIRE than you...

It took me nearly 25 years, and this kid has it all figured out during elementary school.

"I don't expect to be able to escape from the trials of reincarnation, but at least I can escape from the repetitive mechanical loop of life."

He may have put it very crudely in words - 发财.

But what this boy want is not money, but freedom in life, to get rid of the hollowness of life.

He might not know what it is yet, but what he has described is truly FIRE.

It took me nearly 25 years, and this kid has it all figured out during elementary school.

"I don't expect to be able to escape from the trials of reincarnation, but at least I can escape from the repetitive mechanical loop of life."

He may have put it very crudely in words - 发财.

But what this boy want is not money, but freedom in life, to get rid of the hollowness of life.

He might not know what it is yet, but what he has described is truly FIRE.

Saturday, May 19, 2018

Life Updates 2018

1. The Infinity War made me a Marvel fan again! Started going back to look up on many movies I've missed (Dr Strange, Ant Man, Guardians of Galaxy series, etc) and oh my how much have I missed! Guardian of the Galaxy in particular was the cosmic side of Marvel I never knew, and I really enjoyed the humor in that series.

2. Work-wise there isn't really nothing much to say. Operational stuff takes up a majority of the time, and I'm hoping for more opportunities to strengthen my visualization, analytics and maybe even machine learning skillset. There are definitely times when I feel down and dejected, but I have to persevere for my long-term goal.

3. MED is making me feel like it's University Year 1 all over again, almost 10 years apart. She is one of the little happiness I have here, one of the few things that can put a smile on my face, and I don't really want to risk destroying it and have it become a problem. And I always forget my lyrics.

4. Sometimes, I do get overwhelmed with this feeling of solitude. The feeling of really wanting someone to share experiences with. When I'm watching variety show, I wished there was someone to laugh together with. When I want to sing, to watch movies, I wish there was someone that would always be available - some person that I can always hang out with. Maybe it's just the symptoms of getting old. I think it is also affected by having less friends as they all start to have their own families & babies.

I really envy couples like 15HWW, BFGF, KPO and CZM. How lucky are they to find a significant other who share the same FIRE dream? How easy is it to find someone when your "life goal" is so socially unacceptable?

5. While I still attend board game gathering occassionally, frequency has greatly diminished. Now, it's more like once or twice a month. Somehow, I no longer feel the same vibrancy like the past. Maybe it's just people "moving on with their lives", or "running out of fresh games".

6. BTS and their content are taking up a good part of my entertainment these days. This is the first time I have gotten so into a KPop group (in terms of music anyway) and I can definitely see why they are the number 1 group in the world right now (even John freaking Cena is their fan). It's hard to pin-point exactly what made them so successful aside from being just "pretty boys" - A combination of charisma, chemistry, intellectual and goofiness, cheoreogrpahy, music and production effort (years and years of inter-connected storylines and plot in their MVs, it's like a never-ending suspense movie).

It is quite a feat how they bounce back from a company that was on the verge of bankruptcy (when the members were made fun of and some even had to go hungry) to the profitable entertianment label in Korea, surpassing even the Big 3.

Their life stories are reflected heavily in their songs and touch on an extremely wide amount of topics (lyrically), which is very "Mayday-like" (perhaps 1 of the big reason I like them) - prodigy culture in Korea (望子成龙), studying life, their love for music, comparing depressed youths to the 52Hz whale, society stigma, roasting of haters, to even observations like younger generation leeching on their parents, their YOLO attitude, low self-esteem, the list goes on.

Do I feel too old to like them? Kinda, but this ARMY thing really has a cult-like following and it's really quite entertaining. Fellow youtubers confessing to each other online? Reactions? Crack Videos? Run Episodes and all sorts of creative edits?

Some of my favourite songs, in terms of music: Let Me Know, Crystal Snow, Truth Untold, Awake and in terms of performance: Fire, Blood Sweat Tears, Mic Drop.

7. My insomnia problems are sort of getting better, but it's definitely still affecting me. I reckon it occurs about once a week now, but I would eventually be able to fall asleep say around 3am or 4am. It is not as bad as when I literally stay awake till 7am. I'm taken a few measures like early Gabanite, going to bed half an hour earlier, recording any special food or actions I did the night before and avoid them.

8. Health-wise, I really feel I'm getting "out of shape". I didn't have 6 packs or anything, but at least my tummy was flat and lightly defined. Now, it definitely feel like a mini beer belly developing (especially after food). I am determined to do something about it - running at least 2 times a week and doing lots of abdomen exercises.

9. There are sooooooo many games I want to play but I just didn't have the time to follow through. Some were released and brought (and played only like once), while others are upcoming games. Here's a list for everything I need to look at: Civ 6 Rise And Fall, Three Kingdoms Total War, Planet Coaster, Cities Skyline, Twopoint Hospital, Jurassic World: Evolution, Plutrocracy, Tropico 6.

Tuesday, May 01, 2018

Is FIRE an unaccepted idea in Singapore?

I briefly shared the concept of FIRE with a couple of friends lately and while they did not openly denounce it, I can feel them almost sneering at that idea/me. Sadly, FIRE still have a big social stigma in Singapore. I have written about it before, but this time I am actually experiencing it for myself.

I feel you will either come off as trying to show off, having people think you earn a lot, or being totally unrealistic. FIRE is just too foreign to most Singaporeans - retirement is already impossible, and you're think about doing it much early?!

Just look at the amount of diss netizens rain on ASSI, 3Fs and other financial bloggers on the same path or have already achieved the dream. People that can do just do it, people that can't complain. Well, not that I need their approval.

Like this author experience, I think it's an "Asian Culture" problem. FIRE is seen as something "wihout ambition" and failure to contribute to society.

I see friends that are earning much much more than me (talking about near 5 digits) "struggling" to meet payments for all sorts of luxuries - new cars, mature estate HDBs with expensive renovations. Nothing wrong, just different priorities in life.

In fact, FIRE isn't a loftly or noble goal either. In fact, I think FIRE is largely a selfish goal, a goal to serve yourself.

Also, a modern society probably cannot sustain one where everyone else is working towards FIRE and minimialism. In a way, the FIREers are depending on the consumerism behaviour of the masses to survive.

Anyway, what's my ideal age to reach FIRE? I am of the same opinion as the Financial Sumari.

I feel you will either come off as trying to show off, having people think you earn a lot, or being totally unrealistic. FIRE is just too foreign to most Singaporeans - retirement is already impossible, and you're think about doing it much early?!

Just look at the amount of diss netizens rain on ASSI, 3Fs and other financial bloggers on the same path or have already achieved the dream. People that can do just do it, people that can't complain. Well, not that I need their approval.

Like this author experience, I think it's an "Asian Culture" problem. FIRE is seen as something "wihout ambition" and failure to contribute to society.

I see friends that are earning much much more than me (talking about near 5 digits) "struggling" to meet payments for all sorts of luxuries - new cars, mature estate HDBs with expensive renovations. Nothing wrong, just different priorities in life.

In fact, FIRE isn't a loftly or noble goal either. In fact, I think FIRE is largely a selfish goal, a goal to serve yourself.

Also, a modern society probably cannot sustain one where everyone else is working towards FIRE and minimialism. In a way, the FIREers are depending on the consumerism behaviour of the masses to survive.

Anyway, what's my ideal age to reach FIRE? I am of the same opinion as the Financial Sumari.

Sunday, April 01, 2018

Letter To Shareholders (10) - Performance Review 2018Q1

Economy Commentary

Finally we saw a glimpse of the bear in February. Volatility is returning and hopefully we will get some chances to deploy our funds. There were a couple of days when the DOW fell more than 1000 points, but it quickly rebounded. STI hasn't even retract 10% and this is definitely nowhere near major sale-terriority yet.

Macro wise - we have the threat of US-Sino trade war brewing, de-nuclearization of North Korea, more incoming interest hikes and who knows what else the crazy president is going to do.

Locally, there is a lot to learn from the Noble Group saga. When it fell from over $1 to 60c, people were saying "there is no point selling now, it is already so cheap. It can't possibly get any cheaper." Well, cheaper did it get. After a 10-to-1 reverse stock split and more rights issue, it has since lost a further 90+% of its value. The important lesson here is not just that cheap can get cheaper, but how crucial the management are to a company, particularly for a cut-throat business. When you got selfish, incompetent and some might even say corrupted management, it is just not worth investing in the company no matter how cheap it is.

Performance Review Highlights

Our portfolio underperformed for Q1, losing 2% compared to STI which is still up 1% YTD. It was dragged down mostly by the recent REITs correction and the slight decline in Singtel (our biggest holding). At the trough, our portfolio was down as much as by $8000 from peak.

Interesting note: Our equities holding is nearly doubled from the same period last year! This is proof of how much we are pumping into investments.

In this quarter - we added Starhill Global REIT and M1 Limited, decisions we would elaborate more on below. Thanks to Singtel special dividends - we paid out over $2000 in dividends in Q1 (the largest amount of any quarter by far)!

Operating Highlights - Income

I really did not expect main income to exceed the record 2016Q1 figure, but the higher base-income plus good bonus made it about 5% higher. Financial-wise, moving on to this new job is definitely the right move. We made higher income in all the past 4 quarter - and I think the difference will be even more pronounced this year. Looking forward to the year end tally.

On top of one-time income from CNY angbaos, we made some gambling winnings ($300+) this year (compare to a loss last year). Passive income is also signifcantly higher. In local news, government announces a minor angbao to be credited later in this year.

Operating Highlights - Expenses

A lot was spent on insomnia supplements and other sleep aid "devices" . Some of them are quite ridiculous, but I am desparate now. I will try it as long as it has a sound chance of working, and I will continue to hunt for an effective cure. I also "impulse add-on buys" a couple of board games at Amazon for over $150, which are mostly bad buys looking at it now. I don't forsee the games being played much going foward, and it really goes against my minimalism philosophy. Will definitely work on curbing these buys in the future.

2018 marked the first year of giving my mum CNY angbao, and I intend to keep this "tradition" going forward. This made up the bulk of the "one-time" expense category. Interestingly, when I compare recurring expenses for the past 4 years, it is almost equal (within ~5% of each other).

New Account - DBS Multipler

One of the major decision this quarter was moving from OCBC360 to the new DBS Multipler. I will not go into specific review of the Multipler (you can read it here), but for our case, it offers a more compelling rate, especially after the repeated downgrade made to OCBC.

For OCBC 360, I get 1.55% every month, and 1.85% occassionally.

For DBS Mutlipler, I get at least 1.9% every month, often 2.2-2.3%, and perhaps even 3.5%!

A rough estimation:

OCBC: $70000 x 1.6% = $1120

DBS + CIMB: $50000 x 2.0% + ($17000 x 1.0%) = $1000 + $170 = $1170

DBS + Maxigain: $50000 x 2.0% + ($17000 x 2.0%) = $1000 + $340 = $1340

This is assuming the $3K remain in OCBC to maintain the account fall below fee. I am leaving the account open to faciliate switching back if either banks revise their terms in the future, and also it is quite an hassle to close it due to all the GIRO payments.

Other side reasons:

- I no longer have to worry about "clocking $500" to meet the spending requirement of OCBC365.

- I have heard stories of OCBC beinga adamant about not waiving annual fee if you do not meet their spending requirements. This is in preparation for that day. (coming this year October)

Overall, I estimate this shift to earn an additional $200+ of free money per year.

As of now, we still have working capital for 4 more acquisitions - and our watchlist includes Comfort Delgro, Raffles Medical Group, ThaiBev, Mapletree Commercial/Logistic/Greater China Trust, ST Engineering, Netlink Trust and Singtel.

Should a major correction comes a long, we intend to build a more substantial position in STI as long-term foundation - strategy is 1 bullet from 3200 points and another for every 200 points drop.

Finally we saw a glimpse of the bear in February. Volatility is returning and hopefully we will get some chances to deploy our funds. There were a couple of days when the DOW fell more than 1000 points, but it quickly rebounded. STI hasn't even retract 10% and this is definitely nowhere near major sale-terriority yet.

Macro wise - we have the threat of US-Sino trade war brewing, de-nuclearization of North Korea, more incoming interest hikes and who knows what else the crazy president is going to do.

Locally, there is a lot to learn from the Noble Group saga. When it fell from over $1 to 60c, people were saying "there is no point selling now, it is already so cheap. It can't possibly get any cheaper." Well, cheaper did it get. After a 10-to-1 reverse stock split and more rights issue, it has since lost a further 90+% of its value. The important lesson here is not just that cheap can get cheaper, but how crucial the management are to a company, particularly for a cut-throat business. When you got selfish, incompetent and some might even say corrupted management, it is just not worth investing in the company no matter how cheap it is.

Performance Review Highlights

Our portfolio underperformed for Q1, losing 2% compared to STI which is still up 1% YTD. It was dragged down mostly by the recent REITs correction and the slight decline in Singtel (our biggest holding). At the trough, our portfolio was down as much as by $8000 from peak.

Interesting note: Our equities holding is nearly doubled from the same period last year! This is proof of how much we are pumping into investments.

In this quarter - we added Starhill Global REIT and M1 Limited, decisions we would elaborate more on below. Thanks to Singtel special dividends - we paid out over $2000 in dividends in Q1 (the largest amount of any quarter by far)!

I really did not expect main income to exceed the record 2016Q1 figure, but the higher base-income plus good bonus made it about 5% higher. Financial-wise, moving on to this new job is definitely the right move. We made higher income in all the past 4 quarter - and I think the difference will be even more pronounced this year. Looking forward to the year end tally.

On top of one-time income from CNY angbaos, we made some gambling winnings ($300+) this year (compare to a loss last year). Passive income is also signifcantly higher. In local news, government announces a minor angbao to be credited later in this year.

A lot was spent on insomnia supplements and other sleep aid "devices" . Some of them are quite ridiculous, but I am desparate now. I will try it as long as it has a sound chance of working, and I will continue to hunt for an effective cure. I also "impulse add-on buys" a couple of board games at Amazon for over $150, which are mostly bad buys looking at it now. I don't forsee the games being played much going foward, and it really goes against my minimalism philosophy. Will definitely work on curbing these buys in the future.

2018 marked the first year of giving my mum CNY angbao, and I intend to keep this "tradition" going forward. This made up the bulk of the "one-time" expense category. Interestingly, when I compare recurring expenses for the past 4 years, it is almost equal (within ~5% of each other).

New Account - DBS Multipler

One of the major decision this quarter was moving from OCBC360 to the new DBS Multipler. I will not go into specific review of the Multipler (you can read it here), but for our case, it offers a more compelling rate, especially after the repeated downgrade made to OCBC.

For OCBC 360, I get 1.55% every month, and 1.85% occassionally.

For DBS Mutlipler, I get at least 1.9% every month, often 2.2-2.3%, and perhaps even 3.5%!

A rough estimation:

OCBC: $70000 x 1.6% = $1120

DBS + CIMB: $50000 x 2.0% + ($17000 x 1.0%) = $1000 + $170 = $1170

DBS + Maxigain: $50000 x 2.0% + ($17000 x 2.0%) = $1000 + $340 = $1340

This is assuming the $3K remain in OCBC to maintain the account fall below fee. I am leaving the account open to faciliate switching back if either banks revise their terms in the future, and also it is quite an hassle to close it due to all the GIRO payments.

Other side reasons:

- I no longer have to worry about "clocking $500" to meet the spending requirement of OCBC365.

- I have heard stories of OCBC beinga adamant about not waiving annual fee if you do not meet their spending requirements. This is in preparation for that day. (coming this year October)

Overall, I estimate this shift to earn an additional $200+ of free money per year.

Acquisitions

2 big positions taken up this term:

Starhill Global REIT: We have been eyeing to buy it this below 70c. When it seems like it would never come, we finally give in to pay a higher price. Still, it should be decent value. Near 6.5% yield (could drop further in next quarter, but confident that it would stablize once the AEI completes), 0.8P/B, a decent gearing of 35% and generally good management. There are plans by the government to "rejuvenate" Orchard Road - I'll reserve my judgement on how effective it would be.

M1: We would not deny it is partly a gamble to "recoup losses", but there are several positives we are betting on. Management guided lower capex next year ($120M in 2018 vs $150M in 2017), inclusive of spectrum rights. In our view, Q4 results showed sign of bottoming, with revenue increasing, EBITDA stabalizing and increasing customer base.

At worst we forsee another 5-10% drop in earnings. EPS is 14.c in Y2017 - Assuming the worst case drop and EPS of 12.8c, an 80% payout ratio is 10.3c DPU which at $1.74 still gives a 5.9% yield. Assuming a steady DPU of 11c, we are hoping it would yield 6.3%. They have lot of initiatives such as waste management, SG bikes, corporate segment growth which we hope would eventually replace the declining mobile revenue. A secondary factor is confidence boost by several like-minded investors.

2 big positions taken up this term:

Starhill Global REIT: We have been eyeing to buy it this below 70c. When it seems like it would never come, we finally give in to pay a higher price. Still, it should be decent value. Near 6.5% yield (could drop further in next quarter, but confident that it would stablize once the AEI completes), 0.8P/B, a decent gearing of 35% and generally good management. There are plans by the government to "rejuvenate" Orchard Road - I'll reserve my judgement on how effective it would be.

M1: We would not deny it is partly a gamble to "recoup losses", but there are several positives we are betting on. Management guided lower capex next year ($120M in 2018 vs $150M in 2017), inclusive of spectrum rights. In our view, Q4 results showed sign of bottoming, with revenue increasing, EBITDA stabalizing and increasing customer base.

At worst we forsee another 5-10% drop in earnings. EPS is 14.c in Y2017 - Assuming the worst case drop and EPS of 12.8c, an 80% payout ratio is 10.3c DPU which at $1.74 still gives a 5.9% yield. Assuming a steady DPU of 11c, we are hoping it would yield 6.3%. They have lot of initiatives such as waste management, SG bikes, corporate segment growth which we hope would eventually replace the declining mobile revenue. A secondary factor is confidence boost by several like-minded investors.

Outlook

Aside a $1000+ upcoming vocation, recurring expenses should be similar to last year.As of now, we still have working capital for 4 more acquisitions - and our watchlist includes Comfort Delgro, Raffles Medical Group, ThaiBev, Mapletree Commercial/Logistic/Greater China Trust, ST Engineering, Netlink Trust and Singtel.

Should a major correction comes a long, we intend to build a more substantial position in STI as long-term foundation - strategy is 1 bullet from 3200 points and another for every 200 points drop.

Tuesday, February 27, 2018

Quarterly Results Review - 2017Q4

It was a rough February as volatility returns to the US and I finally saw signs of the long-awaited bear. My portfolio suffer a massive drawdown of over $9000 in a mere 3 weeks (dropping as much as $2200 in a single day).

Other wealthier bloggers are experiencing as much as $30K drawdown or even 5 digits "loss" in a single day.

That said, I'm super hyped. I've been waiting forever for the return of this Great Singapore Sale.

M1

As I expect, the earnings seems to have bottom (for now), with 4Q PAT dropping by 2.5%, and full year PAT down -11.5%. Subscribers are stable (slight growth) while usual stuff like international roaming continue its downtrend. Full year dividend at 11.4c (80% payout ratio).

The stock price picked up a little but I still don't have the conviction to average down on this. There are no guidance on next year earnings (they say it's too early to tell).

As before, they are branching into other areas like malware detection solutions, nationwide IOT, smart sensors, "intelligent" waste management system, cloud offering of digital startups. Whether they will take off remains to be seen.

CapitaCommercial Trust

Good results (DPU up 8.66%, 6% higher) but the stock price have shot through the sky. I really should have grit my teeth and sell when it was at more than $2. It is really unstainable considering the yield at that price is below 5%.

I believe it would be more fairly valued at $1.65 for a 5.5% yield, or at best $1.8 for 5% yield. The market are pricing in lot of growth from their AEI and Asia Square acquisition.

CapitaMall Trust

As usual, stable dividend cash-cow. Expect stable 11c DPU (5.4% yield at $2.04) until the launch of Funan in 2019.

Frasers Centrepoint Trust

Share price exploded with the launch of Northpoint City. Usual comment:

My crown holding - low debt level (29%), 11 years of increasing DPU, NAV grown from 1.78 to 2.02 since I first vested in 2014, best management, super resilient. Every single quarter the results is good. What more can you ask for?

Singtel

The wide market downturn finally broke Singtel $3.6 support.

At $3.40, Singtel currently trades at 10x EV/EBITDA, below its five year historical mean of 12x. It is also supported by a attractive yield of 5.1% (or 17.5c, for such a strong blue chip). P/E is close to 10!

I would definitely add on more if I weren't already so heavily vested in it. I think I will fire one more bullet should it falls to $3.3, and reserve 1 final bullet for $3.

Given the "wide-ranging impact" of Singtel (Singtel shares, Temasek Holdings, favourite of retirees) and its curent payout ratio, I think the chance of dividend cut is remote. The CEO herself have also started buybacks at $3.3x.

Frasers Property

Frasers Centrepoint Limited renamed. Its share price has been on a downtrend since hitting $2.25.

Profit took a big 46% hit this quarter, but is expected due to the lumpy nature of property development. I like that recurring income has now grown to over 70%..

Current NAV is $2.46, and I expect dividends to be maintained at 8.6c a year. I am still comfortable with this "ETF", and might add on more should it come to $1.7 (30% discount to NAV, 5% yield).

Far East Hospitality Trust

DPU falls 13.4% to 0.97c. At this yield of 5.5%, I think market is pricing for the recovery to happen in 2019 (management guides continued competitive environment for next few quarters). Not sure how much the AEI and macro "tourism" events would have on the profitiability.

For now, I will just leave this as it is (not a big position) and might sell if the price keeps going up.

Accordia Golf Trust

DPU drops 19% and there seems to be no turn-around in sight. Kind of regret not selling when it hit over 78c, but no one expected the deposit returns losses and 2 consecutive bad quarters.

Now, it is back at my entry price, but I have still earned substantial dividends from this counter.

Management continue to iterate Japan's economy recovery, hopefully it prorpogates down to this counter. I will seriously consider selling it if the price rebounds or fundamentals continue to weaken.

Sembcorp Industries

Dividends continue to get cut (full year 5c, from 8c in 2016 and 11c in 2015). EPS down from 19.9c to 10.5c It is weird that Urban Development have taken over Marine as the 2nd biggest segment.

Looking forward to the IPO of Sembcorp Energy India.

Netlink Trust

Nothing much to say - everything according to forecast results and on track to meet target DPU.

Link to DBS Report

Watchlist

Comfort Delgro - $1.9 and below would be extremely tempting.

SGX - Closer to $7. India exchange saga impact unknown.

Raffles Medical Group - Closer to $1. High P/E but long term growth story.

ThaiBev - A lot hinges on their Vision 2020. Debt is crazy after the acquisition spree. Might be cheap at 80c, but I would wait for lower to be safe.

Starhill Global Reit - Results weakening slightly but recovery expected in 2nd half. Assuming annualized dividends of 4.68c, provides 6.5% yield at $0.72. I also think it has a good management due to this article.

Mapletree Comm Trust - Below $1.5, camping at 6% yield. NAV is $1.37.

Mapletree Logistic Trust - Despite >10% retracement still pretty expensive. If it comes closer to book value, say $1.1.

ST Engineering - Would likely bite at 5% yield (closer to $3)

Capitaland - Look closer to $3.3 or below.

Mapletree Greater China Trust - $1.1 or when it retract to more than 7% yield.

Other wealthier bloggers are experiencing as much as $30K drawdown or even 5 digits "loss" in a single day.

That said, I'm super hyped. I've been waiting forever for the return of this Great Singapore Sale.

M1

As I expect, the earnings seems to have bottom (for now), with 4Q PAT dropping by 2.5%, and full year PAT down -11.5%. Subscribers are stable (slight growth) while usual stuff like international roaming continue its downtrend. Full year dividend at 11.4c (80% payout ratio).

The stock price picked up a little but I still don't have the conviction to average down on this. There are no guidance on next year earnings (they say it's too early to tell).

As before, they are branching into other areas like malware detection solutions, nationwide IOT, smart sensors, "intelligent" waste management system, cloud offering of digital startups. Whether they will take off remains to be seen.

CapitaCommercial Trust

Good results (DPU up 8.66%, 6% higher) but the stock price have shot through the sky. I really should have grit my teeth and sell when it was at more than $2. It is really unstainable considering the yield at that price is below 5%.

I believe it would be more fairly valued at $1.65 for a 5.5% yield, or at best $1.8 for 5% yield. The market are pricing in lot of growth from their AEI and Asia Square acquisition.

CapitaMall Trust

As usual, stable dividend cash-cow. Expect stable 11c DPU (5.4% yield at $2.04) until the launch of Funan in 2019.

Frasers Centrepoint Trust

Share price exploded with the launch of Northpoint City. Usual comment:

My crown holding - low debt level (29%), 11 years of increasing DPU, NAV grown from 1.78 to 2.02 since I first vested in 2014, best management, super resilient. Every single quarter the results is good. What more can you ask for?

Singtel

The wide market downturn finally broke Singtel $3.6 support.

At $3.40, Singtel currently trades at 10x EV/EBITDA, below its five year historical mean of 12x. It is also supported by a attractive yield of 5.1% (or 17.5c, for such a strong blue chip). P/E is close to 10!

I would definitely add on more if I weren't already so heavily vested in it. I think I will fire one more bullet should it falls to $3.3, and reserve 1 final bullet for $3.

Given the "wide-ranging impact" of Singtel (Singtel shares, Temasek Holdings, favourite of retirees) and its curent payout ratio, I think the chance of dividend cut is remote. The CEO herself have also started buybacks at $3.3x.

Frasers Property

Frasers Centrepoint Limited renamed. Its share price has been on a downtrend since hitting $2.25.

Profit took a big 46% hit this quarter, but is expected due to the lumpy nature of property development. I like that recurring income has now grown to over 70%..

Current NAV is $2.46, and I expect dividends to be maintained at 8.6c a year. I am still comfortable with this "ETF", and might add on more should it come to $1.7 (30% discount to NAV, 5% yield).

Far East Hospitality Trust

DPU falls 13.4% to 0.97c. At this yield of 5.5%, I think market is pricing for the recovery to happen in 2019 (management guides continued competitive environment for next few quarters). Not sure how much the AEI and macro "tourism" events would have on the profitiability.

For now, I will just leave this as it is (not a big position) and might sell if the price keeps going up.

Accordia Golf Trust

DPU drops 19% and there seems to be no turn-around in sight. Kind of regret not selling when it hit over 78c, but no one expected the deposit returns losses and 2 consecutive bad quarters.

Now, it is back at my entry price, but I have still earned substantial dividends from this counter.

Management continue to iterate Japan's economy recovery, hopefully it prorpogates down to this counter. I will seriously consider selling it if the price rebounds or fundamentals continue to weaken.

Sembcorp Industries

Dividends continue to get cut (full year 5c, from 8c in 2016 and 11c in 2015). EPS down from 19.9c to 10.5c It is weird that Urban Development have taken over Marine as the 2nd biggest segment.

Looking forward to the IPO of Sembcorp Energy India.

Netlink Trust

Nothing much to say - everything according to forecast results and on track to meet target DPU.

Link to DBS Report

Watchlist

Comfort Delgro - $1.9 and below would be extremely tempting.

SGX - Closer to $7. India exchange saga impact unknown.

Raffles Medical Group - Closer to $1. High P/E but long term growth story.

ThaiBev - A lot hinges on their Vision 2020. Debt is crazy after the acquisition spree. Might be cheap at 80c, but I would wait for lower to be safe.

Starhill Global Reit - Results weakening slightly but recovery expected in 2nd half. Assuming annualized dividends of 4.68c, provides 6.5% yield at $0.72. I also think it has a good management due to this article.

Mapletree Comm Trust - Below $1.5, camping at 6% yield. NAV is $1.37.

Mapletree Logistic Trust - Despite >10% retracement still pretty expensive. If it comes closer to book value, say $1.1.

ST Engineering - Would likely bite at 5% yield (closer to $3)

Capitaland - Look closer to $3.3 or below.

Mapletree Greater China Trust - $1.1 or when it retract to more than 7% yield.

Wednesday, January 24, 2018

Insomnia Problems III

This is the 3rd time I'm blogging about this in a year and I have really exhausted all options.

How It Started / Worsen

As far as I remember, I started having insomnia problems as far back as 2015. At that time, I thought it was caused by a poor mattress which is partly why I replaced the whole thing.

After that, it still occurs once in a while, but usually with a clear cause - Some unhappy event in the day, major stimultant before bedtime, overly anxious about upcoming event etc. Once in a while it will happen with no apparant cause.

This continue through my ex-job until Nov 2016. Frequency as far as I remember is about once or twice a month.

It became extremely bad this year. The first month of 2018 is barely over and I've already had 5 sleepless nights, often consecutively. It's so bad then I had to repeatedly take half days in order not to suffer panic attacks during the afternoon.

The worst thing is, there are no apparant cause now. Competely adhoc occurences with no pattern.

I think it's a vicious cycle - when I fail to sleep for 1 night for some reason, I would go to sleep the next day fearing that I won't be able to sleep - a self fuilfilling cause.

I don't know if it is the insomnia that is causing me stress, or the stress that is giving me insomnia.

Everything I've Tried

I've googled hundreds of articles and advices. Everything you can think of to combat insomnia, I've done it.

1. Sleep meditation, sleep hypnosis, sleep music (delta waves), ASMR videos, white noise app, sounds of nature, random podcasts playing the background - I've prowled through hundreds of them on Youtube.

2. Lavender scent, eating supposedly sleep inducing food including banana, milk, bread, camomile tea.

3. Deep breathing exercises, yoga poses (dozens of them), pattern breathing, supposed tricks to sleep.

4. Blue screen filter at night, wearing socks, keep temperature cool, exercising, yadda yadda.

5. Supplements. Many different type of supplements.

2 years ago, insomnia was annoying but tolerable. Today, it is really having a big negative impact on my life. I am pretty sure my frequent migranes and cold aliments originate from have bad sleep so often.

What Am I Doing About It?

I am trying to record as much details as possible right now, and trying different combinations and variables to make identify the cause.

Like trying different time to go to bed, drinking/not drinking milk, exercising at different timing, etc.

Hopefully I can finally find a pattern that will eventually work.

How It Started / Worsen

As far as I remember, I started having insomnia problems as far back as 2015. At that time, I thought it was caused by a poor mattress which is partly why I replaced the whole thing.

After that, it still occurs once in a while, but usually with a clear cause - Some unhappy event in the day, major stimultant before bedtime, overly anxious about upcoming event etc. Once in a while it will happen with no apparant cause.

This continue through my ex-job until Nov 2016. Frequency as far as I remember is about once or twice a month.

It became extremely bad this year. The first month of 2018 is barely over and I've already had 5 sleepless nights, often consecutively. It's so bad then I had to repeatedly take half days in order not to suffer panic attacks during the afternoon.

The worst thing is, there are no apparant cause now. Competely adhoc occurences with no pattern.

I think it's a vicious cycle - when I fail to sleep for 1 night for some reason, I would go to sleep the next day fearing that I won't be able to sleep - a self fuilfilling cause.

I don't know if it is the insomnia that is causing me stress, or the stress that is giving me insomnia.

Everything I've Tried

I've googled hundreds of articles and advices. Everything you can think of to combat insomnia, I've done it.

1. Sleep meditation, sleep hypnosis, sleep music (delta waves), ASMR videos, white noise app, sounds of nature, random podcasts playing the background - I've prowled through hundreds of them on Youtube.

2. Lavender scent, eating supposedly sleep inducing food including banana, milk, bread, camomile tea.

3. Deep breathing exercises, yoga poses (dozens of them), pattern breathing, supposed tricks to sleep.

4. Blue screen filter at night, wearing socks, keep temperature cool, exercising, yadda yadda.

5. Supplements. Many different type of supplements.

2 years ago, insomnia was annoying but tolerable. Today, it is really having a big negative impact on my life. I am pretty sure my frequent migranes and cold aliments originate from have bad sleep so often.

What Am I Doing About It?

I am trying to record as much details as possible right now, and trying different combinations and variables to make identify the cause.

Like trying different time to go to bed, drinking/not drinking milk, exercising at different timing, etc.

Hopefully I can finally find a pattern that will eventually work.

Saturday, January 20, 2018

Jiro Dreams of Sushi

I got to know this beautiful documentary through one of my favourite financial blog, Four Pillar Freedom.

The jist of the film in my opinion is summarized below by the writer below:

"If there was no film made about Jiro, it would be easy to look at his life from the outside and mistakenly believe that he is an 85 year-old man who never achieved retirement, who remained at the same sushi restaurant for several decades, who never made the leap to a larger business, and who lacks meaning.

This would be a classic mistake of thinking a meaningful life has to look a certain way.

I think we all want to find meaning in life. Unfortunately, we have a tendency to look for it in the wrong places. Instead of chasing autonomy, competence, and connection, we strive to accumulate more things."

---

Yes. Bigger houses, brighter diamonds, luxurious cars. This is what success in Singapore means.

How about we all learn from Jiro?

How about just living each day doing what you love?

Do you care more about how you look to others?

Or more about how YOU feel about your life?

---

While I do not agree with all of Jiro's philosophy (like throwing your kids and leaving them to fight for themselves, or being extremely tough of himself), I admire his unrelentless dedication to his craft. He is the epitome of becoming one with what he love. (Kinda like 人剑合一 in Wuxia films. Haha.)

While the film seems to have nothing to do with finances on the surface, it can teach you a lot when you look deeper.

One big reason why Jiro was able to carefreely pursue his passion is because money is no longer a factor in his life. He has complete autonomy over his life, and he choose to use his time on what gave him the most happiness - making better sushi.

---

I think no matter what we intend to puruse in life, achieving FI is the common factor that can help us, solely because it grants us total control our time.

The jist of the film in my opinion is summarized below by the writer below:

"If there was no film made about Jiro, it would be easy to look at his life from the outside and mistakenly believe that he is an 85 year-old man who never achieved retirement, who remained at the same sushi restaurant for several decades, who never made the leap to a larger business, and who lacks meaning.

This would be a classic mistake of thinking a meaningful life has to look a certain way.

I think we all want to find meaning in life. Unfortunately, we have a tendency to look for it in the wrong places. Instead of chasing autonomy, competence, and connection, we strive to accumulate more things."

---

Yes. Bigger houses, brighter diamonds, luxurious cars. This is what success in Singapore means.

How about we all learn from Jiro?

How about just living each day doing what you love?

Do you care more about how you look to others?

Or more about how YOU feel about your life?

---

While I do not agree with all of Jiro's philosophy (like throwing your kids and leaving them to fight for themselves, or being extremely tough of himself), I admire his unrelentless dedication to his craft. He is the epitome of becoming one with what he love. (Kinda like 人剑合一 in Wuxia films. Haha.)

While the film seems to have nothing to do with finances on the surface, it can teach you a lot when you look deeper.

One big reason why Jiro was able to carefreely pursue his passion is because money is no longer a factor in his life. He has complete autonomy over his life, and he choose to use his time on what gave him the most happiness - making better sushi.

---

I think no matter what we intend to puruse in life, achieving FI is the common factor that can help us, solely because it grants us total control our time.

Subscribe to:

Posts (Atom)