This could be one of the most insightful set of visuals.

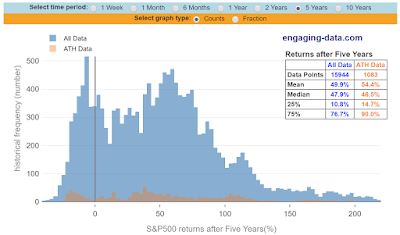

If Millennials are planning for retirement 30-40 years from now, they should know the stock market has never cut a loss over any 20-year period from 1926–2015.

The odds of realizing a positive stock return are 100% over any 20-year period during that timeframe. Let me repeat. Stocks have never seen a loss over any 20-year time period from 1926-2015. Never. Not once.

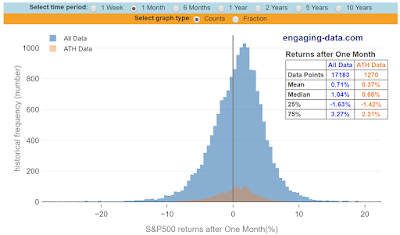

But what about over shorter intervals, you ask? How about 10 years? A sobering 94% of the time there was a gain. 5 years? 86%.

What if you buy today and hope to sell it for a profit next week? Your chances are barely better than a coin flip.