*All figures exclude CPF, investment capital gains/losses (but include dividends).

-------------------------------------------------------------------------------------------------------------------------

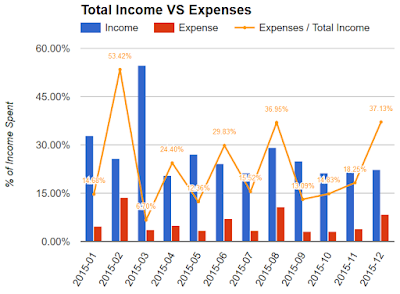

Total Income VS Total Expenses

Expenses were pretty much stable except for the months where I made "major purchases", most notably a new mattress in February, Dividend Machine course in April, Langkawi trip in June, Samsung Galaxy S6 in August, Cameron Trip + S6 repairs in December. I also spent slightly more on minor indulgence stuff in December to 慰劳 myself a bit.

Income were highest in January and March from bonuses, and there's a minor National Day bonus in August. Can't wait for the upcoming one to top-up my war chest!

Other fluctuations in income are mostly due to dividends payout. Being my first year of investing, this will take some time to stabalize as I "lock down" on the stocks I have (receiving full year worth of dividends), and having each subsequent purchase make up less of my portfolio.

Other fluctuations in income are mostly due to dividends payout. Being my first year of investing, this will take some time to stabalize as I "lock down" on the stocks I have (receiving full year worth of dividends), and having each subsequent purchase make up less of my portfolio.Overall, I managed to saved near 82% of my total income. My plan is to reinvest and inject at least 70% into my portfolio every year. Let's get the snowball rolling!

-------------------------------------------------------------------------------------------------------------------------

Recurring Income VS Recurring Expenses

The chart strips out the noise and highlight only the "recurring" portion of my cashflow.

Recurring income include only salary + passive income, and excludes 'one-time' items like lottery winnings, angbaos, SAF allowance, bank special promotions, etc...

Recurring expenses remove all "major purchases" and "vacations".

-------------------------------------------------------------------------------------------------------------------------

Recurring Expenses Breakdown

As expected, my top expenses are food, utilities, personal and travel. Other random discoveries:

- I spent about $12-$15 on average each month on lottery tickets. -.- So far, I only "won" $10 back. They are indeed a bad investment. Treat them purely as entertainment.

- Of all the entertainment expenses, about 50% of them comes from KTV sessions. LOL. Does it imply most of my entertainment come from singing, or is it because singing is the most expensive form of entertainment?

Food: Breakfast, Lunch, Dinner, Supper, Snack, Groceries

Entertainment: Any form of entertainment expenses such as KTV, Video Games (e.g. Purchases from Steam), Movies, Sports, Etc

Gambling: Any Losses from Lottery, Mahjong, etc...

Healthcare: Doctor, Dentist

Household: Consumables (e.g. Stationary, Toiletries), Others (e.g. Pillow, Bedsheets)

Personal: Things that are consumed personally by me, such as Clothing (e.g. Head to Toes), Haircut, Personal Care (e.g. Toothpaste, Skincare, Grooming), Other (i.e Exercise Stuff, Army)

Social: Wedding, Social Functions

Tax: Income Tax

Travel: Public (e.g. EZ-Link Topup), Taxi

Treat: Non-personal expenses

Utilities: Telephone, Internet

----------------------------------------------------------------------------------------------------------------------

Road To Financial Independence

Passive income now cover almost 20% of my expense! Not bad for my first full year of investing!

I have exceeded my goal for 2015 by collecting more passive income. The short term negative impact though - it's like exchanging "capital losses" in the process.

Given the market correction (i.e Great Singapore Sale), I will selectively accumulate on weakness to further accelerate my yield next year. Goal next year is to generate 1 month salary from stock dividends.